Introduction

When you apply for a loan, you often have the opportunity to select a loan with a variable interest rate or one with a fixed interest rate, either in part or in full.

A variable interest rate can change over time as determined by the lender.

With a Fixed Rate, the rate of interest is set for a period of time, often from one to five years.

A lender will often offer a borrower the opportunity to have part of their loan balance at a Variable Rate and the remainder at a Fixed Rate.

This is known as a Hybrid Rate Loan.

What causes a lender to change their Variable Rate?

Most often, a change to the Variable Rate will follow a change by the Reserve Bank’s Official Cash Rate (OCR).

More recently, lenders are often seen to be taking into account other factors such as the cost of the funds a lender pays to borrow from overseas institutions.

Unfortunately, for this reason, lenders (led by some of the Big 4) sometimes do not pass on the full rate reduction suggested by the downward movement of the OCR.

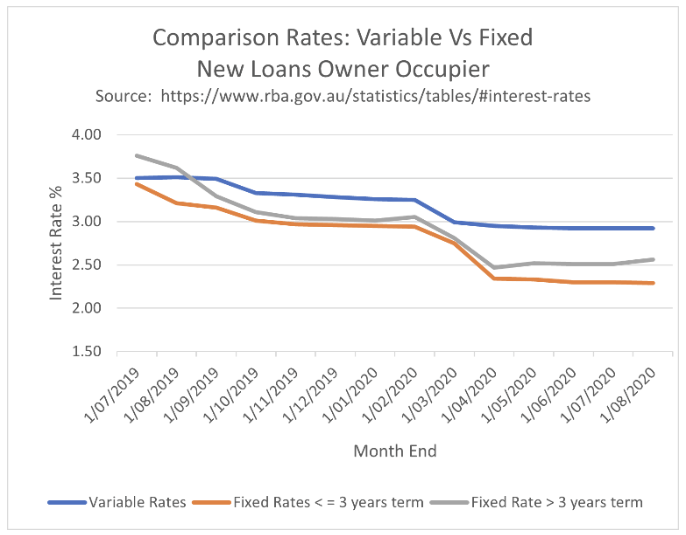

Do Variable Rates and Fixed Rates ‘follow’ each other up and down?

Generally, variable and Fixed Rates tend to mimic each other in terms of overall movement but many factors can lead to variations between the two.

And to make it even more confusing, sometimes Fixed Rates are higher than Variable Rates and sometimes they are lower.

The factors which come into play include expectations of future interest rate movements (both locally and overseas) plus movements in the wholesale interest rates market, both locally but often overseas, from where a lot of a lender’s funds may be sourced.

So, the discrepancy between the two rates and whether Variable Rates are lower or higher than Fixed Rates is not a simple equation.

In fact, it is quite complicated and convoluted and certainly not transparent!

Variable Rates

Features

– The interest rate may go up and/or down during the term of your loan. Generally, it will not vary more than once a month, if at all.

Pros of Variable Rate loans

– More loan features which may give you greater flexibility.

– You can make early repayments or pay off your loan sooner (including refinancing with another lender) without paying break costs.

As noted earlier, break costs are those costs charged by a lender to a borrower when the borrower wishes to terminate a Fixed Rate loan before the expiry date of the loan term (often arising when the borrower wishes to sell their home).

– Some Variable Rate loans act as a continuous line of credit. This means you can access any available funds if you need money for something else later on (but there may be fees for this).

Cons of Variable Rate Loans

– Your repayments fluctuate with the current Variable Rate, so you don’t have as much certainty and may end up paying more interest than you planned (but also note: ‘the rate may go down as well so you save money’).

And, as noted above, the movement in the rate is based on conditions outside your control.

– The uncertainty over repayments can make budgeting harder. This can be particularly relevant in the first few years of your loan as your income is unlikely to change significantly during this time.

– The flexibility and extra loan features can come at the cost of a higher interest rate. For example, some ‘low rate’ loans have limited features and may even have restrictions as to what you can do and when you can do it.

Fixed Rates

Features

– Fixed rate loans are generally fixed for a period, typically years.

– Most Fixed Rate terms are from one to five years.

Not all lenders and not every lender’s products will offer every variability within this timeframe.

– At the end of the Fixed Rate term, your rate reverts to the current variable loan rate from your lender.

Pros of Fixed Rate Loans

– They make budgeting easier as you know how much you need to pay every month for the term of the Fixed Rate loan.

– The cost (interest rate) may be less as there are fewer features (e.g. redraw and offset may be non-existent or significantly reduced).

– You can set up automatic repayments for the term of the loan as the payments are fixed each month at the same amount.

– You can lock in a Fixed Rate when applying through a ‘rate lock’.

This means if interest rates move up after you apply, but before settlement, you get the benefit of the Fixed Rate at the time you submit your application.

Cons of Fixed Rate Loans

– If rates go down, you won’t benefit from the rate reduction during the term of your loan.

– If you wish to pay off your loan sooner or refinance, there may be break costs or early repayment fees.

Hybrid rate loans

Features

– Part of your total loan is a Variable Rate loan with the balance being a Fixed Rate loan.

– You may choose to have part of your Fixed Rate loans for different time periods.

For example: your total loan you apply for is $500,000. You choose to have $300,000 on a Variable Rate loan, $100,000 on a Fixed Rate loan, fixed for 1 year and $100,000 on a Fixed Rate loan, fixed for 3 years.

Our take

– No matter what the forecasters say about the future of interest rates, the reality is no one knows what is going to happen in the future.

Even with all the known information available, there are still a number of unknown factors which can influence the amount and timing of any change in interest rates.

– So, all forecasters (and you) can do is make educated guesses as to the direction and timing of any changes.

Other than any educated guess, the decision to either take a variable interest rate product or a fixed interest rate product is often a matter of 2 things to do with your feelings:

1. Your feelings around adversity Vs missing out on something good:

Are you the sort of person who stresses if something adverse happens or are you the sort of person who stresses if you miss out on something good?

2. Your feelings around cashflow stress:

Are you the sort of person who stresses if your cashflow gets tight due to higher payments?

– Everyone is different and everyone’s appetite for risk is different so there is no ‘one answer is correct’ advice.

And, when you are dealing with joint applicants, you need to take into account the risk profile of each applicant.

Just because one applicant might be comfortable with a higher level of perceived risk, the other applicant might be a little bit more conservative; so you need to balance the attitudes of both applicants.

As part of our due diligence when we assist you in identifying a suitable loan, we undertake a Needs Analysis for each person applying.

On a scale from 1 to 10, we inquire about your level of worry regarding the escalation of interest rates.

Additionally, we discuss with you the benefits and drawbacks of considering a Fixed Rate loan, either partially or entirely.

Lastly, we always ask about the members of your team.

What we want to know is, have you got a great team of advisors to assist you in making important decisions?

Because when you are dealing with loans of hundreds of thousands of dollars, you need knowledgeable, ethical professionals advising you of your risks.

Check our Financial Calculators!

Book a time here with me to know more about each rate: Calendly