Hi,

Next month’s news cycle is likely to be dominated by the upcoming federal budget. In the meantime, here are four important stories making headlines:

– Borrowers in refinancing mood

– ATO targeting property investors

– Property market rebounds

– Banks supporting green consumers.

Read more below.

But first, our regular updates!

This month’s

Lender’s Carrot – equity release loans

There is a novel equity release loan (i.e. cash out) when you are looking to sell but settlement hasn’t yet occurred.

It’s great for that quick pre-sale reno, the deposit for your next purchase, or even a holiday – you name it, you spend it!

All interest and principal is repaid when you settle on the sale of your home so no monthly cash costs. And, you have up to 6 months to settle.

Client Story – a business owner needs cash

The client’s business needed a short-term cash facility to urgently purchase stock which it could on-sell during the winter cold and flu season.

An unsecured loan was organised and funding provided within the week.

To my client I said ‘Rather than focus on the rate, focus on the profit you will forgo if you don’t get the money. As long as you make money after all costs, it is a good deal.’ (Of course, the more you make the better!).

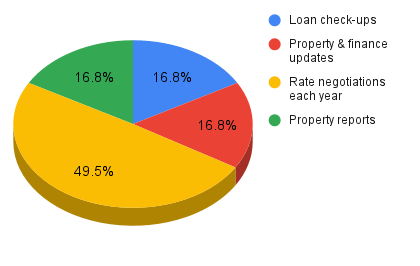

Our survey results are in!

Our question was: For those borrowers who use a broker to get a loan, what is the BEST “other thing” your broker does for you?

Some observations:

– This range of services offered by brokers are not ones which you would anticipate a lender could, or would, offer their clients.

A broker has a best interest duty to provide solutions for their clients which are not only of great value for the client but which are presented in a way which shows objectivity and transparency.

Compared to a broker, however, a lender has a much lower level of compliance in terms of best interests duty.

– So it is not surprising that brokers’ clients receive services which create enormous value and which lenders will not and cannot offer.

This shows the strength of the broker channel and may well explain why over 70% of loan clients use a broker.

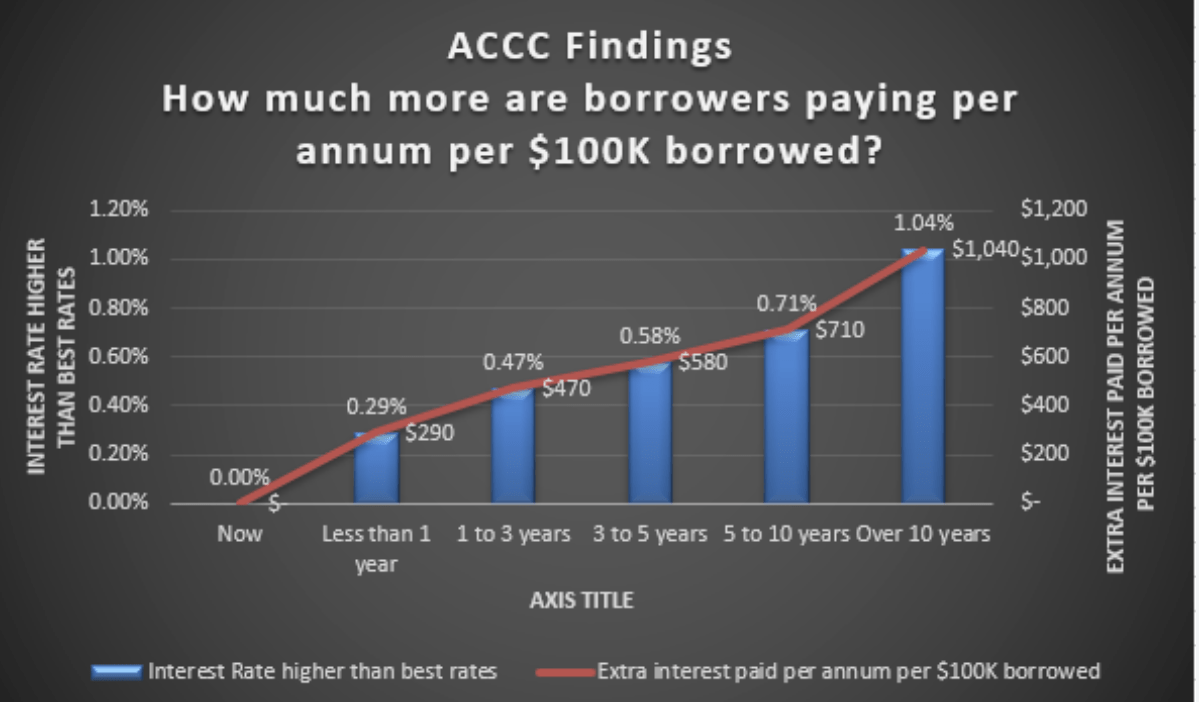

– The regular negotiation of rates is a key area of value for clients.

As readers of my Blogs will know, I am fond of quoting the ACCC’s 2020 report on the mortgage industry which showed that the longer a loan was held by a client, the greater the difference between ‘best rates’ and the rate being paid; with the difference costing a client thousands of dollars a year. See the graph below.

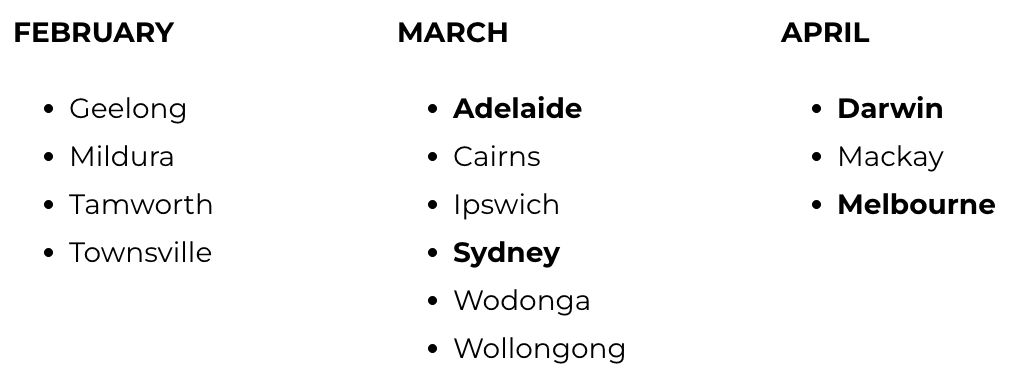

Regional Property Report Updates

You can access over 30 Regional Property Market analyses. Many of these Reports have over 50 pages of detailed information including whether to consider to Buy, Hold or Sell.

The regions cover all capital cities plus regional cities across Australia.

The last 3 months updated Reports:

Click here for access to our Regional Reports!

Product Highlight

Suburb Comparison Report

The good folk at Pricefinder, the research house behind Domain.com.au (and which is used by many real estate agents), has given us access to use their Suburb Comparison Report.

The 15 year historical growth trends for up to 5 suburbs can be compared in a series of neat graphs.

This is great for when you are looking at suburbs which might have underperformed and you want to take advantage of any arbitrage in value. Or, just to have a sticky beak 😉

Of course, we go one step further! For each suburb you choose, we also give you Pricefinder’s Suburb Flyover Report; a more detailed analysis for each suburb you have selected.

Click here for your Suburb Comparison Report!

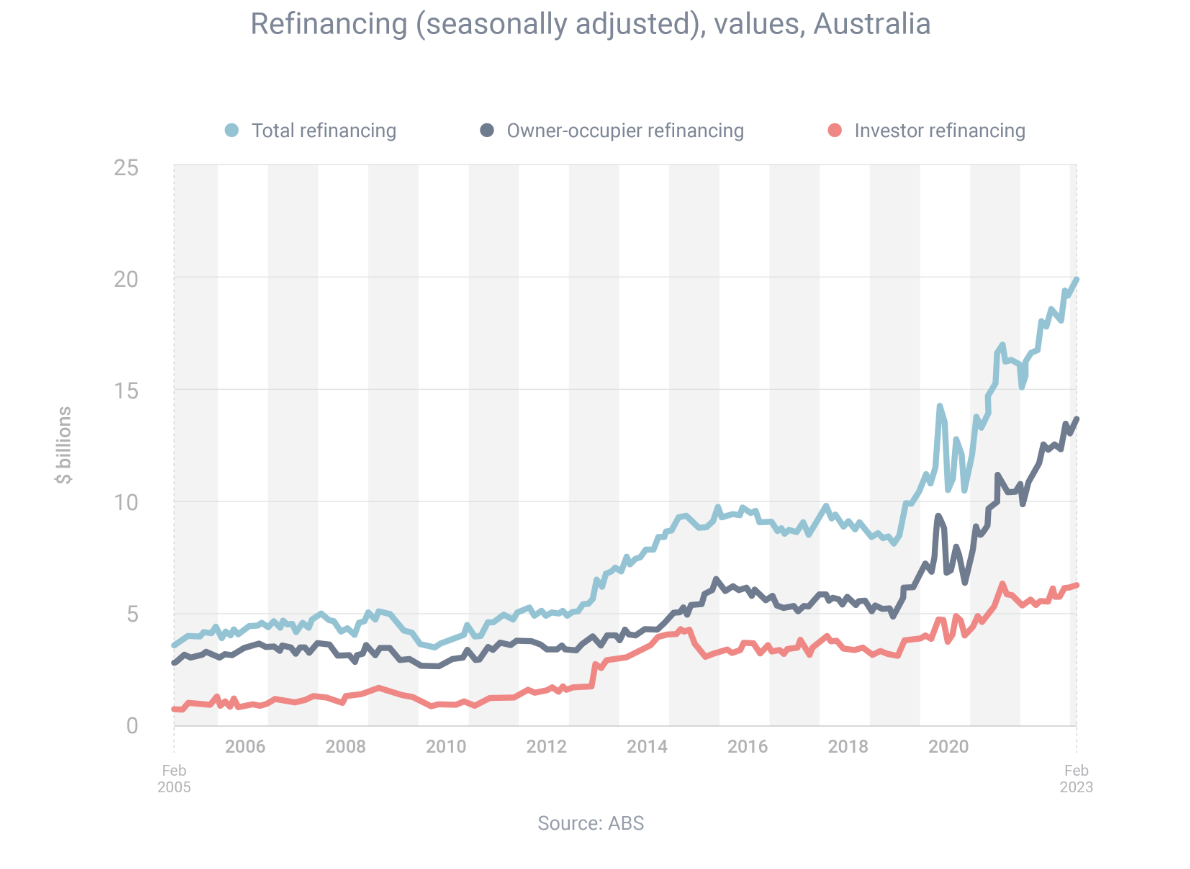

Hordes of borrowers switching to lower-rate loans

According to the latest data from the Australian Bureau of Statistics (ABS), the 10 biggest months in refinancing history have been the 10 most recent ones.

This streak began in May 2022, when $17.1 billion of home loans were refinanced, and has persisted through February 2023, which is the most recent month for which data is available.

Borrowers set a new record in February by refinancing $19.9 billion. ABS spokesperson Dane Mead attributes this record to the Reserve Bank of Australia’s (RBA) series of cash rate increases. He notes that borrowers continued to switch lenders for lower interest rates as the RBA’s cash rate rose.

Since the RBA began increasing the cash rate in May 2022, it is not unexpected that a large number of people have refinanced their loans.

Currently, lenders are fiercely competing for business and offering attractive deals to refinancers such as rate discounts and cashback incentives.

Contact me today if you’d like to see how much you could save by refinancing.

Want to refinance? Let’s talk!

ATO chasing property investors for $1.3bn in missing taxes

According to The Guardian, to ensure that property investors are accurately filing their tax returns, the Australian Taxation Office (ATO) will require banks to provide data on 1.7 million property investors.

The ATO estimates that $1.3 billion in missing taxes could be collected through this effort.

All of the big four banks and 13 other financial institutions will be required to provide the requested information using formal information gathering powers.

The most common tax errors made by property investors include:

– misclassifying improvements as repairs instead of capital works,

– incorrectly apportioning mortgage interest costs after refinancing for private purposes, and

– failing to apportion expenses for private use of the property.

The ATO can use advanced data-matching technology to compare property investors’ financial transactions with what they report on their tax returns.

The vast majority of property investors want to do the right thing, but taxes are complicated so mistakes can occur. To avoid mistakes, property investors are advised to seek professional tax advice.

That’s why I recommend you get professional tax advice.

If you need a good accountant, feel free to contact me for a recommendation.

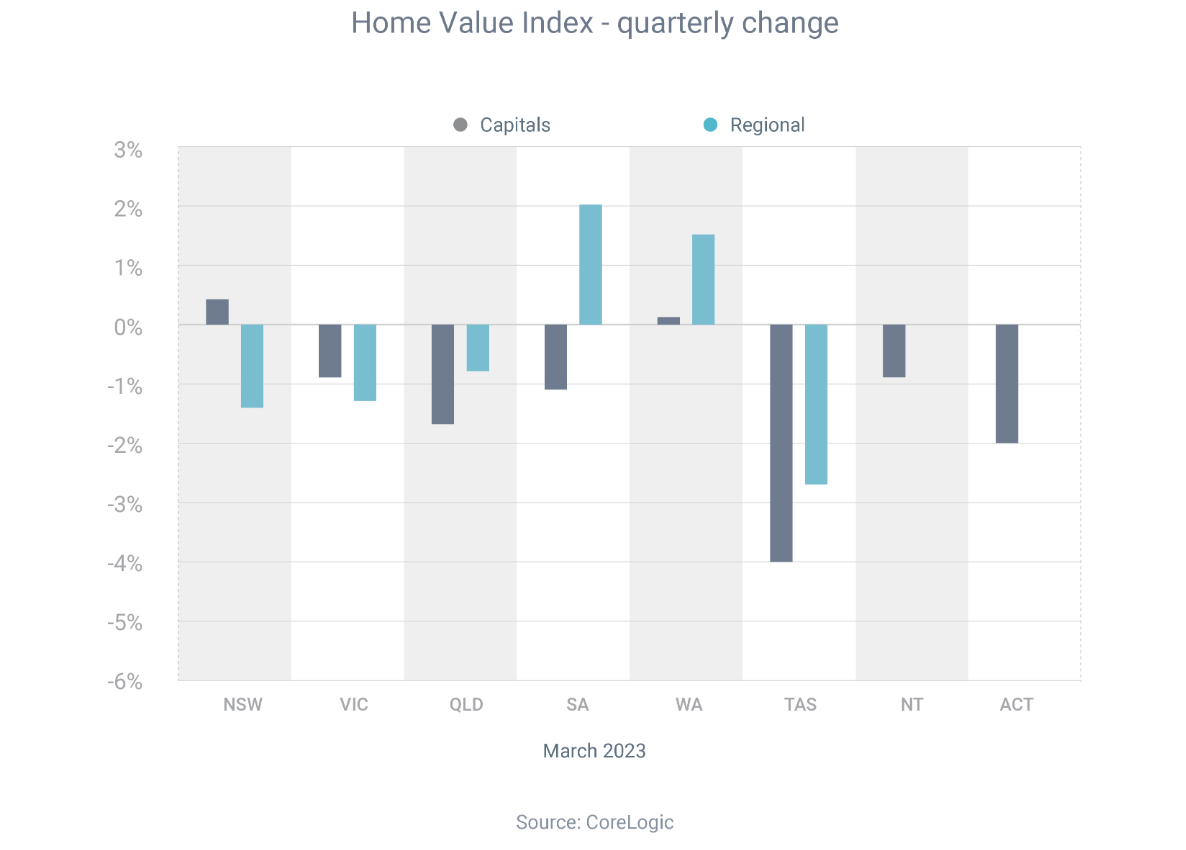

Why the property market has staged a rebound

After experiencing a decline in property prices across the country for about a year, there are signs that certain markets may have hit their lowest point.

In March, Australia’s median property price rose by 0.6%, marking the first monthly increase in 11 months, according to CoreLogic.

This was largely driven by median price growth in the four largest capital cities in Australia.

– Sydney – up 1.4% month-on-month.

– Melbourne – up 0.6%.

– Perth – up 0.5%.

– Brisbane – up 0.1%.

At the same time, prices declined in the other capitals:

– Adelaide – down 0.1%.

– Darwin – down 0.4%.

– Canberra – down 0.5%.

– Hobart – down 0.9%.

CoreLogic’s research director, Tim Lawless, said the housing turnaround was due to three main factors:

– Low supply of new listings, which were almost 20% below the five-year average in the combined capital cities.

– Increased demand from tenants, who were trying to escape the challenging rental market.

– Increased demand from migrants, with net overseas migration at record levels.

Big four banks and other lenders keen to finance ‘green’ purchases

Due to the growing demand for electric vehicles, solar panels, and other sustainable technology, several banks are now providing specialised “green” loans.

These loans typically come with more favourable borrowing terms and lower interest rates than traditional loans, as many lenders are eager to promote the shift towards a cleaner economy.

Depending on the lender, you can use green loans to finance the purchase of:

– Electric vehicles (EVs)

– EV charging stations

– Hybrid vehicles

– Solar panels

– Battery systems

– Solar hot water systems

– Heat pumps

– Energy-efficient appliances

As always, conditions apply, and different lenders have different credit policies.

Reach out if you would like to buy an EV, solar panels or other sustainable technology. I’ll be happy to explain your options and manage the loan application for you.