Hi,

Just a friendly reminder that if you do your own taxes, you need to lodge your tax return by October 31. In the meantime, here are four stories about property, finance… and taxes:

– Some fixed loans getting cheaper

– Why banks will have to go green

– New property listings rise 6.5%

– Tax tips for property investors

Read more below.

But first….

The results of our recent survey!

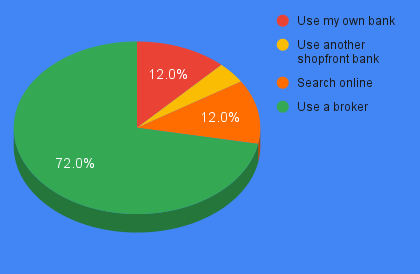

We recently asked our social media followers the following question:

Survey: How would you organise your next loan?

Not surprisingly, these results reflect the industry-wide statistics which show 70% of borrowers use a broker.

As you know, there are good reasons for using a broker – but as some of you have told us, not all brokers are created equal. 😉

One thing we do a little differently

Apart from offering timeliness, responsiveness, objectivity, experience and expertise, we are always looking at ways to add value for our clients.

For those of you who are clients, you will already have experienced our Free Property Report service. But, now there’s even more!!!

#1 Annual Property & Loan Reviews

These Reports will provide a full analysis of your property using the research grunt of domain.com.au and realestate.com.au. PLUS we will show you:

– Your capital and equity growth from last year.

– Your equity at 80% LVR as we know most lenders and borrowers prefer to borrow up to 80% so they don’t have to pay Lenders Mortgage Insurance (LMI).

#2 Our (up to) Five Suburb Comparison Reports

Are you looking at which suburb to invest in?

You can now order a Suburb Comparison Report for up to 5 suburbs! This can be ultra-handy for investors wanting a quick overview of some suburbs they might be considering investing in.

#3 Updates to our 30+ Region Reports

Our Region Reports produced by Sharon Taylor, Research Director, Performance Property Advisory, have been updated for the following regions: Ballarat <> Bendigo <> Tamworth <> Cairns <> Geelong <> Townsville.

Check out these reports and PPA’s Property Clocks for these regions (Buy / Hold / Sell).

Click the button below to get access to your Free Property Report!

With all the talk of interest rate rises, you might not have noticed that some lenders have been reducing rates on their fixed-rate loans. And, hot off the press, some variable rates are also on the decrease with some lenders – although probably for different reasons as set out below.

However, variable rates are likely to continue to rise in line with future Reserve Bank of Australia cash rate increases, which are all but guaranteed.

But some fixed loans have been coming down lately. And, as noted above, some variable rates have also dropped slightly – but it seems with the provision of assisting those with better risk profiles (e.g. lower LVRs).

Whereas with variable rates, lenders often take their cue from the RBA, they tend to reference financial markets when setting fixed rates.

Markets had priced in RBA rate rises longer before they occurred, which is why lenders started increasing their fixed rates as early as December 2020.

Now, though, some lenders have concluded the RBA won’t increase the cash rate as much as they originally thought; and, therefore, that they went a bit far with their fixed increases.

As a result, some lenders have trimmed interested rates on their fixed loans — although they remain quite a bit higher than variable rates.

Interest rates can be confusing, so contact me if you want to discuss whether it’s best to have a fixed loan, a variable loan or a split loan (which is part fixed and part variable) in this current environment.

Australian banks, like those around the world, will have to increasingly adopt ‘nature-positive’ policies that enhance rather than degrade our environment.

Two international organisations — the Task Force on Climate-related Financial Disclosures and the Taskforce on Nature-related Financial Disclosures — are creating frameworks for banks and other organisations about pricing and disclosing nature-related risks.

Banks will increasingly account for the impact their lending activity has on the planet, which will influence who they lend to, the terms they set and the interest rates they charge.

A new report from Deloitte, ‘Banking on Natural Capital’, has listed steps banks need to take to become nature-positive institutions. They include changing internal incentive structures and reallocating capital to nature-positive activities.

“The regulatory, market and stakeholder pressure to reduce detrimental impacts on nature and increase positive ones will only continue to increase,” according to the report.

“With this pressure also comes potential opportunities, as demonstrated through the rise of sustainable finance, impact investments, and voluntary carbon markets.”

The first half of 2022 has seen a noticeable increase in for-sale properties across Australia, with more new listings in the first six months than during any half-year since 2015, according to PropTrack.

Meanwhile, the number of new listings (defined as those less than 30 days old) in July was 6.5% higher than the same month last year.

Drilling down to the capital city level, seven of the eight capitals experienced year-on-year increases in new listings:

– Adelaide listings in July were 27.0% higher than the year before

– Hobart up 25.1%

– Sydney up 18.2%

– Melbourne up 5.9%

– Brisbane up 3.5%

– Darwin up 0.7%

– Canberra down 3.3%

This is good news for buyers because the more properties there are on the market, the more choice and less competition buyers experience.

If you want to buy a property, it’s important you contact me for a pre-approval before you begin the searching process. That way, you’ll know your budget. Also, vendors will be more likely to approve your offer if they know you have finance in place.

Property investment is one of the key areas the Australian Taxation Office has said it is focusing on this tax season.

The ATO Random Enquiry Program found that nine out of ten tax returns that reported rental income and deductions contained at least one error, even though most of those investors used a registered tax agent.

To make sure property investors get their tax returns right, the ATO has provided four pieces of advice;

First, declare all your income, including from Airbnb and rental bond payments, because the ATO almost certainly has data on these transactions and will catch you if you don’t.

Second, get your expenses right. Some can be claimed straight away (such as property management fees), while others can only be claimed over a number of years (such as capital works).

Third, if you sold your investment property during the 2021-22 financial year, you need to report whatever capital gain or loss was made.

Fourth, you need to keep all relevant records for at least five years, in case the ATO asks you to prove any of your claims.