Introduction

When you apply for a loan, you will often have to choose between Principal & Interest (Principal & Interest) payments and Interest Only repayments. As the name suggests, with Principal & Interest payments, you are paying your lender the interest cost for the month plus a portion of the principal you have borrowed. Over time, your loan balance will reduce. With Interest Only payments, you are only paying your lender the interest cost for the month so your loan balance will not reduce.

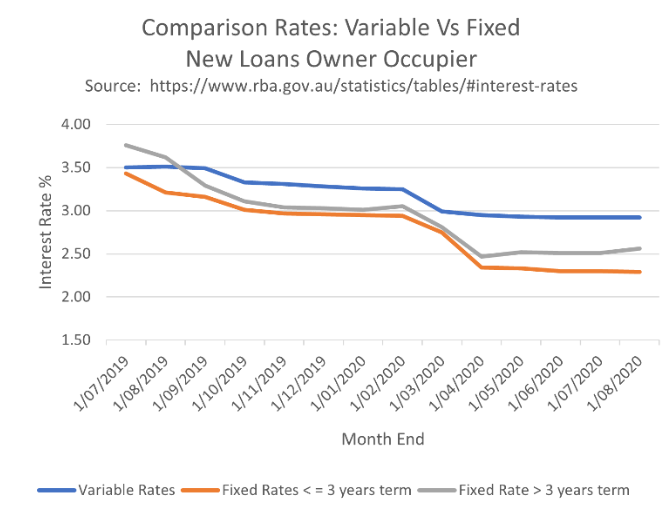

The type of payment you choose (between Principal & Interest and Interest Only) is likely to impact the interest rate you are charged. In the data below, sourced from the RBA’s most recent set of statistical tables (current as at October 2020), you can see that there is a 0.7% pa premium to have an Interest Only facility compared to a Principal & Interest facility.

Further, depending upon a lender’s perception of the current market risk as well as your personal risk, they might not be willing to offer you an Interest Only option, preferring you to take up a Principal & Interest facility.

Lenders typically favour Principal & Interest as it reduces your loan and therefore their exposure over time. It also fits in nicely with their expected end goal: that your loan is repaid. Whilst you can repay your loan by selling your property or refinancing with another lender, repayment of the loan in a steady repayment stream over the life of the loan is often seen as preferable by lenders.

Principal and Interest Payments

Features

– The monthly repayment is based on the current interest rate, the loan term and the balance required at the end of the loan term. For a Variable Rate loan over a typical 25 loan term, the balance at the end of the loan term is normally set at nil. If, however, you had an Interest Only facility for the first three years of your loan, the Principal & Interest monthly payment amount for the remainder of your 25-year loan would be higher than if you opted for a Principal & Interest facility from Day 1 as there will be three years fewer in which to repay the principal amount.

– As can be seen below, the amount of the Principal & Interest repayment devoted to repayment of the principal increases over time as the interest is calculated on the principal balance remaining at the end of each month.

Note: This analysis excludes fees and charges.

– The higher the interest rate at the time you take out the loan, the higher the overall repayment and the greater the proportion of the repayment which will be devoted to paying the interest (and proportionally less will be devoted to the repayment of the principal).

Note: This analysis excludes fees and charges.

Pros of Principal & Interest Payments

– As noted from the RBA data, you may receive a lower interest rate so more of your repayment can be allocated to a reduction in principal. For example, over a year, for a $500,000 loan, if the Principal & Interest rate is 0.5% pa interest rate lower than the Interest Only interest rate, then this difference can be used to repay a further $2,500 in principal.

– Because Principal & Interest payments are considered more prudent by lenders, a loan with a Principal & Interest facility is often easier to obtain.

– Every time you make a reduction in the principal owing, there is a compound effect on the amount of future interest you have to pay as with Principal & Interest, the interest you pay is based on the balance of the loan outstanding at the beginning of the month. (This is why making additional or slightly higher payments each month is recommended as the benefit of the principal reduction has a compounding effect for the balance of the loan period).

– There is an inherent reduction in stress levels when you are reducing the principal owing – sometimes the satisfaction of seeing the balance reducing can give you a nice internal smile at the end of a day!

Cons of Principal & Interest Payments

– Your cash payment is higher each month as you are paying your interest plus a portion of the principal you borrowed.

– For Investors, part of your cash flow is tied up on non-tax deductible repayments (i.e. the repayment of the principal). Please seek independent tax advice before considering this issue.

Interest Only Payments

Features

– Each month, you only pay the lender the interest you owe.

– At the end of the month, the same amount is owing to the lender as was owing at the start of the month – and this does not change during the term of the Interest Only loan.

Pros of Interest Only Payments

– You do not need as much cash flow available each month to make the monthly payments.

– There may be tax deductible benefits for Investors. For this, please seek independent tax advice.

Cons of Interest Only Payments

– As noted in the RBA data, your interest rate may be higher than if you had selected a Principal & Interest product.

– It can be harder to obtain than a Principal & Interest product as many lenders have a natural bias in favour of Principal & Interest products.

– Your loan balance does not reduce.

– In times of tough economic conditions, if housing prices suffer a fall in value, you may find it harder to obtain refinance as your loan to value ratio (LVR) may have increased more than if you were paying Principal & Interest payments.

– When it comes time to revert to a Principal & Interest repayment, your payments will be higher than you would have paid at the beginning of your loan. Based on the above examples, at an interest rate of 3.0% pa, on a $750,000 loan over 25 years, the Principal & Interest payment is $3,556 per month. If you had a 5-year Interest Only product and then reverted to Principal & Interest at the end of the 5-year period, your Principal & Interest payment for the remaining 20 years would be $4,159 – an increase of $603 per month.

– An Interest Only facility can be more stressful for some borrowers who like to see some gains for all the money they pay out in interest as the amount they owe their lender does not decrease.

Our take

– This is the same as our view for variable and fixed rates.

– While lower repayments for an Interest Only facility can seem intuitively better as you reduce the impact on your monthly cashflow, you are also delaying the repayment of the principal and so you are paying more in interest. For some borrowers, this trade-off is worth it as it allows them to enter the housing market and get started; or, it allows them to maximise the benefit of potential tax advantages if they are an Investor (again, seek independent tax advice on this issue).

– As with our comments on variable and fixed rates, it is important to note that everyone is different and everyone’s appetite for risk is different so there is no ‘one answer is correct’ advice. And, when you are dealing with joint applicants, you need to take into account the risk profile of each applicant. Just because one applicant might be comfortable with a higher level of perceived risk, the other applicant might be a little bit more conservative; so you need to balance the attitudes of both applicants.

– As part of our due diligence when we assist you in identifying a suitable loan, we undertake a Needs Analysis for each person applying. We ask you what your level of concern is about rising interest rates. We also ask you if you would like to consider a fixed rate loan, either in part or in full, and we go through with you all the features, pros and cons.

– We always ask ’Who is on your team?’. What we want to know is, have you got a great team of advisors to assist you in making important decisions? Because when you are dealing with loans of hundreds of thousands of dollars, you need knowledgeable, ethical professionals advising you of your risks.