Author: Michael Royal

Finance Specialist

M: 0411 190 474

The finance markets are always changing. Lenders are regularly updating their products and providing new points of difference to help them compete and gain market share.

Plus, the number of lenders has never been more diverse. Whilst the High Street lenders (the Big 4 plus a few regional players) dominate the lending landscape, there are now so many more lenders to choose from; lenders who are offering products that fit niches which the major lenders do not cater for. Plus, their rates are often as sharp or sharper than the major lenders.

And, as with many consumer-based products where there are a few large suppliers, existing customers don’t always get the same deal which is being offered to new clients – unless they ask for it.

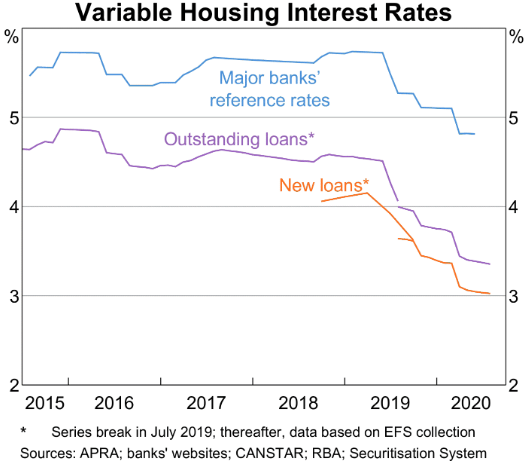

This is confirmed by the Reserve Bank of Australia. Since 2018, new customers have, on average, been getting a much better variable rate than existing customers.

Here are the 8 reasons you should consider refinancing:

#1. Rates for existing customers may not keep up with rates for new loans.

With regular movements in interest rates, you need to regularly confirm your lender (and more importantly, your lender’s product) is keeping up with any downward trend.

#2. Lenders are not obliged to give you their cheapest rate product.

As a broker, I am not interested in what is best for the lender – I want what is most suitable for you!

#3. Lock in lower rates with a fixed interest rate package.

Fixed rates are often available over a 1-to-5-year term. Whilst many borrowers have only used variable interest rate products, you can put some or all of your loan into a fixed rate package and keep some of it at variable rates and take advantage of some very low fixed rates to reduce any future potential adverse interest rate movements.

#4. Reduce your loan costs.

Some packages offer better costs or features which provide the opportunity for incurring lower costs.

#5. Get a loan with better features.

Which is more suitable for you and lower your costs. For example, if you don’t have an offset account, your surplus cash flow is earning less interest in your savings or cheque account than what you are paying on your loan. As a result, you could well be paying more interest than you need to. (Note: There may be some costs involving an offset account so some analysis needs to be done but for many borrowers, it saves them significantly more than it costs.)

#6. You can consolidate your debts.

Have you built up some personal debt or personal loans (and even vehicle loans) and are paying higher unsecured/credit card or non-property interest rates? Refinancing and consolidating your debts and paying the current property-backed interest rates can lower your cash repayments immediately. (However, it is important to also set up a plan to pay off these debts so you don’t continue paying for the ‘consolidated debt’ over the full term of your home loan!)

#7. You can pay off your tax debt!

As many business owners know, you can get into ‘cashflow strife’ when you do not pay on time the amounts you owe to the ATO (e.g., GST, PAYG deductions or employee super). Plus, unpaid overdue tax debt can impact your ability to get finance when you want or need it down the track. Not all lenders offer this feature but we have quite a few lenders on our panel who can assist you.

#8. Use your equity in your current property for other purposes e.g. investment or renovations.

Your equity increases when the value of your home increases and/or you have been paying down your borrowings through a Principal and Interest (P&I) facility or by using an Offset account. Together with your financial planner, you may decide to build your wealth through the purchase of an investment property or shares. Or, you may decide to do some renovations and perhaps use the Government’s scheme for owner occupiers (up to $25K for renovations up to $150K – conditions apply). Or, just take a well-earned holiday!

If refinancing looks like it could be of interest to you, here are some things you might also need to consider:

✔️ If you are currently in a fixed rate package, there may be a break cost if you are looking to refinance.

✔️ If you don’t have enough surplus equity, then refinancing might not be the most suitable option for you. Typically, I would suggest you consider refinancing when your current Loan to Value Ratio (LVR) is less than 80% (and preferably much lower).

✔️ If you are struggling with your current repayments, seeking to refinance may not be in your best interests right now. Instead, you might need to focus on your income and expenditure. There are some excellent services and products in this area of budget and spending control to assist you.

Would you like more information? You can ring us now 1300 989 878 or email us at moreinfoplease@bir.net.au